- Views: 6K

- Replies: 19

India is approaching a significant decision in its military aerospace programme, with expectations set for selecting an international partner by July 2025 to co-develop a sophisticated sixth-generation jet engine. This crucial engine is destined for the country's future Advanced Medium Combat Aircraft (AMCA).

Negotiations have recently concluded with three global aerospace leaders: General Electric (GE) of the United States, Safran of France, and Rolls-Royce from the United Kingdom, marking the final stages before a partnership is formed.

This anticipated agreement, under the close observation of the Prime Minister’s Office (PMO), details essential elements including a development timeline, project costs, work distribution between partners, the level of technology transfer (ToT), and the handling of intellectual property rights (IPR).

Securing favourable terms is vital for India's ambition to build independent capabilities in advanced military propulsion systems.

The AMCA project, a cornerstone of India's defence modernisation efforts, is being developed by the Defence Research and Development Organisation (DRDO) and Hindustan Aeronautics Limited (HAL) as a 5.5-generation stealth aircraft. The initial version, AMCA Mk-1, is scheduled for its first flight around 2030 and will utilize existing GE F414 engines.

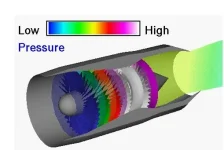

However, the more advanced AMCA Mk-2 variant, expected by 2040, requires a substantially more powerful engine generating 110-130 kilonewtons (kN) of thrust. This new powerplant is needed to achieve capabilities such as supercruise (supersonic flight without afterburners), enhance stealth performance, and support future systems like artificial intelligence-driven drone swarms and directed-energy weapons.

It is anticipated that this next-generation engine might incorporate variable cycle technology for improved fuel efficiency and thermal management, potentially serving as a base for future Indian fighter aircraft as well.

The comprehensive engine development programme carries an estimated cost of around $5 billion. This budget covers the engine's design, development, setting up domestic production lines, building prototypes, and conducting extensive ground and flight testing procedures.

The Indian Air Force (IAF) has a long-term goal of reaching a strength of 42 fighter squadrons by 2047. Therefore, the timely development of this indigenous engine capability is critical to meet the projected 2035 production commencement for the AMCA, ensuring India maintains a technological edge against regional air capabilities.

The recently concluded discussions involved detailed proposals from GE, Safran, and Rolls-Royce, covering all aspects from development roadmaps to cost and technology sharing.

According to sources, Rolls-Royce has emerged as a potential frontrunner. This is reportedly due to its experience with sixth-generation engine technology via the UK-led Global Combat Air Programme (GCAP, associated with the 'Tempest' future fighter).

Rolls-Royce has proposed a collaborative development partnership offering complete transfer of intellectual property rights, which would give India full control over the engine's design, production, and future upgrades – a crucial element for long-term self-reliance. Their offer also includes establishing manufacturing facilities within India and support for testing, aligning with the government's "Make in India" initiative.

Nevertheless, Safran of France remains a strong competitor, highlighting its extensive experience with fighter engines like the M88 (which powers the Rafale jets currently operated by the IAF).

Safran has reportedly made a compelling offer involving 100% technology transfer, including IPR. This would allow India to manufacture the engine domestically and adapt it for future requirements without external constraints, addressing past concerns over limited technology sharing.

Safran's existing collaborative history with India further strengthens its position. General Electric, while a known partner supplying engines for India's Tejas aircraft and the initial AMCA Mk-1, is thought to be offering less extensive technology transfer, potentially limited by U.S. export control regulations, which could impact India's operational autonomy.

The final decision rests on a careful balance of technological offerings, strategic alignment, and geopolitical considerations. Rolls-Royce’s potential advantage lies in its access to advanced technologies from the GCAP and its offer of a tailored engine design with full ownership and export rights for India.

Safran, however, presents the appeal of complete technological independence via unrestricted ToT and builds on a smoother partnership history. The choice made by July 2025 will significantly shape the future of India's indigenous aerospace and defence capabilities for years to come.